Rewards Program

Where Banking With Highmark Rewards You

What's New

All Highmark members can enjoy the following:

- FREE Checking!1

- NO Minimum Savings Account Balance Fee!

- NO Overdraft Transfer Fees!

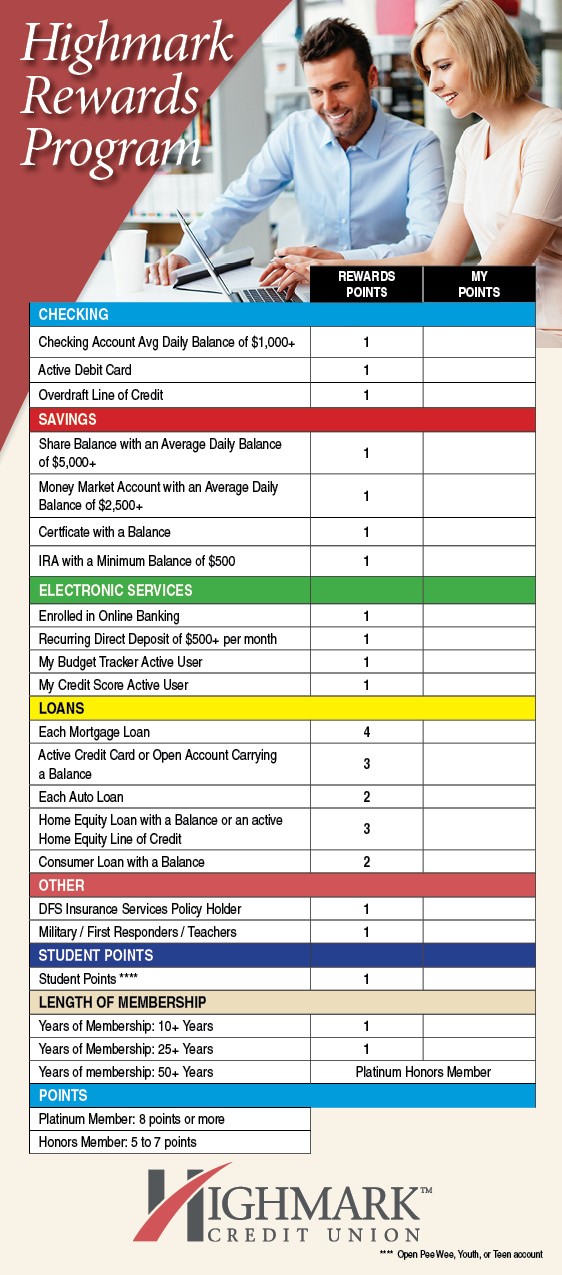

How To Earn Points

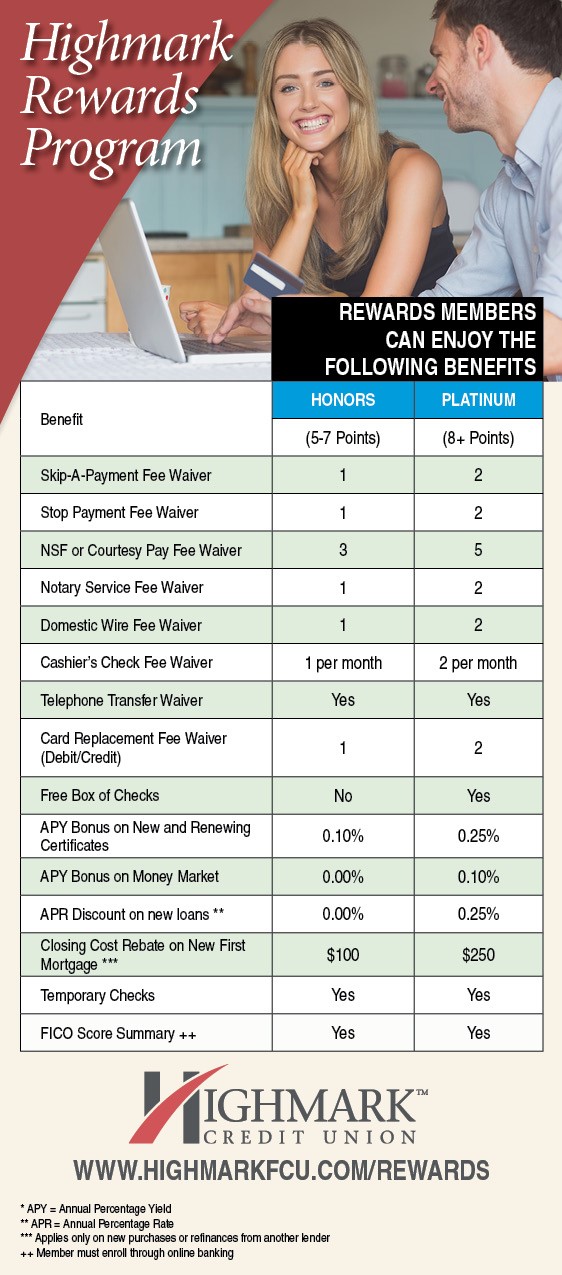

Benefits Associated With Your Points

How To See My Points

How To Redeem

Example: If you are a Platinum member on two separate accounts, then you may have 2 free Skips on each account per fiscal year.

LIMITS:

- 1 box of free checks per year.

- 8 starter checks per year.

- APR loan discounts apply to Highmark "in-house" loans. They do NOT apply to Mortgage loans.

Rewards Program Membership is available to all Highmark Credit Union members age 18 and over. Eligibility begins at the end of the month after account opening. Youth Accounts are not eligible for Rewards Membership. You must be a member in good standing with the Credit Union and keep at least $1.00 in your Regular Share Account to be eligible. Members who have been disqualified from Honors Membership are not eligible for the 50+ Year Relationship. Accounts are reviewed regularly to determine continued eligibility for Membership. Members can advance at any time during the calendar year unless they are no longer a member in good standing or have less than $1.00 in their Regular Share Account. Once attained, Rewards Membership is good through December 31 of that calendar year and is reviewed at that time to ascertain continued eligibility.

Membership benefits will be reviewed on an annual basis. We reserve the right to modify the terms and conditions of Rewards Membership at any time. Certain terms and restrictions apply.

Rewards Membership is achieved for individual accounts. Members with multiple accounts must achieve Rewards Points for each account.

Bonus on Money Market Accounts

Eligibility for the bonus is based on Membership level. Eligibility for the bonus continues as long as Rewards Membership is maintained, based on annual evaluation. The bonus is applied to the Annual Percentage Yield (APY) beginning the first of the month after you achieve Honors Membership or Platinum Membership. The loss of the bonus is retroactive to the first day of the month in which you no longer qualify for Platinum Membership.

Bonus for New and Renewing Certificates

Existing Members: Eligibility for the bonus is based on the Membership level. Existing members who open a new Certificate or have an existing Certificate will receive an increased bonus as they advance through Rewards Membership, based on a monthly evaluation on the last calendar day of the month.

The bonus is applied to the Annual Percentage Yield (APY). If a member becomes ineligible for the bonus, the bonus will be suspended and will not be reinstated during the calendar year. The loss of the bonus is retroactive to the first day of the month in which the member no longer qualifies for a Rewards Membership.

The bonus may be applied to (add to) a special Share Certificate Rate offered by Highmark Credit Union.

APR Discount On New Loans

This discount does not apply to mortgages or lines of credit.

Closing Cost Discount

Eligibility for a closing cost discount is based on Rewards Membership level at time of loan origination plus the relationships that the member would achieve with the new loan. The amount of the discount is based on Rewards Membership level at the time of loan origination. The discount is valid for new purchases and when a member refinances a mortgage loan from another lender to Highmark. It is not valid for refinances on an existing Highmark mortgage. Contributions towards borrower's closing costs from third parties including the lender credit cannot exceed maximum limits established by the loan program for which the borrower qualifies.

Skip-a-Pay

If you take advantage of Skip-a-Pay, your loan(s) will continue to accrue interest during that time. Deferring your loan payment will extend the term of your loan(s); you always have the option of making additional or larger payments in the future to pay down your loan faster. Real estate, business, and visa loans are not eligible for Skip-a-Pay. Other terms and restrictions apply. Please ask for details.

Courtesy Pay

Courtesy Pay Program allows the Credit Union to automatically pay member checks, ACH debits, debit card transactions (if opted in) and Bill Payer transactions presented for payment against non-sufficient funds. Courtesy Pay is not a guaranteed overdraft line. The Credit Union is under no obligation to pay any items that would cause an overdraft balance but retains the right to do so at our sole discretion. The fee for Courtesy Pay is the same as NSF items returned as disclosed in our Schedule of Fees and Charges. However, through Rewards Membership, members may request up to five fee waivers per year depending on membership status. After an account has been overdrawn for 14 consecutive days, no further overdrafts will be paid. Furthermore, if an account is overdrawn for 30 consecutive days, that account may be charged off and the membership maybe restricted. Use of Courtesy Pay is subject to additional terms and restrictions.