Fraud and Disputes

What is the difference between fraud and merchant dispute?

The primary difference between a fraudulent transaction and a disputable transaction lies in whether or not you, the account holder, initiated the transaction with the merchant in the first place.

- Disputes can arise between a merchant and account holder for a variety of reasons. These reasons can range from overcharging the account holder, charging for merchandise that wasn’t received, or charging for a monthly subscription that was previously cancelled.

- If the transaction was never authorized or initiated by the account holder, a fraud claim may be filed.

Answering the following questions will help you to determine whether your claim is a dispute or fraud.

- Do you personally know who made the transaction to your card, or to your account via ACH?

- Is the transaction a result of signing up online for a “free trial,” however you used your card to pay for shipping or a similar charge?

Did you give or loan your card to anyone? (You cannot make a claim of any kind if you voluntarily gave your card to another person.)

Disputable Transactions

When you have a disagreement with a merchant about a charge they made to your Highmark VISA card, this is considered a cardholder dispute. For example:

- You cancelled a transaction, but the merchant still charged you. For instance, you used your card to reserve a hotel room, and cancelled with the hotel in accordance with their cancellation guidelines, and you were still charged for the room.

- You purchased an item using your card, and later returned the item to the merchant, but your card was never credited for the return.

- You were charged an incorrect amount for a transaction, for example $200 rather than $20.

- You have an issue with the quality of goods or services provided.

What you must do if you need to file a merchant dispute

- Contact the merchant first and document your efforts to resolve the dispute directly with them.

- If you are either unable to resolve the dispute with the merchant or they have failed to follow through with a promise to refund your charges, contact the credit union.

- Provide all documentation supporting the transaction and your attempt to first work out the dispute with the merchant (e.g. receipts, letters to/from the merchant, etc.).

- We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem appeared.

Fraudulent Transactions

A fraudulent transaction occurs only when you have no knowledge of who used your Highmark VISA card and you can state with certainty that you were not aware of the transaction. You will be asked to provide a copy of the police report if your card has been lost or stolen.

If you believe you have a fraudulent charge or need to dispute a charge on your card, please contact us as soon as possible.

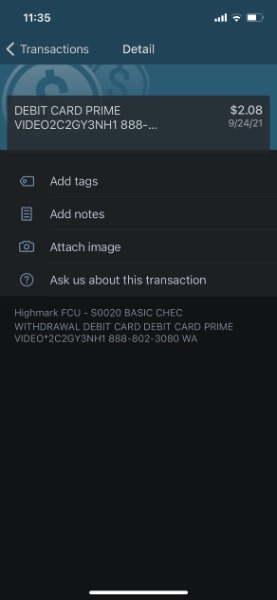

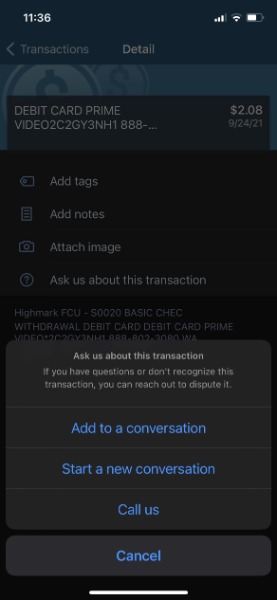

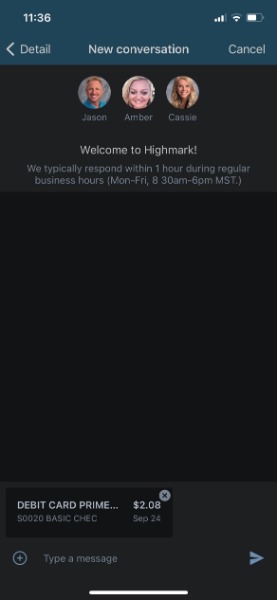

Online/Mobile Banking Options

If you bank online or use the Highmark mobile app, you always have the option to start an inquiry about a particular transaction. See screenshots below for more guidance.